Financial Regulation

The governing factors of the monetary system, both domestic and international.

WISE Investments

New Podcast Series: PostPandemicInvestments.com

An educational podcast series dedicated to financial awareness for both novice and seasoned investors. We discuss the ideology into creating this one-of-a-kind educational resource center, focusing on financial awareness within a post-pandemic reality.

Listen to Financial Regulation here.

Frequently Asked Questions

Financial Regulation

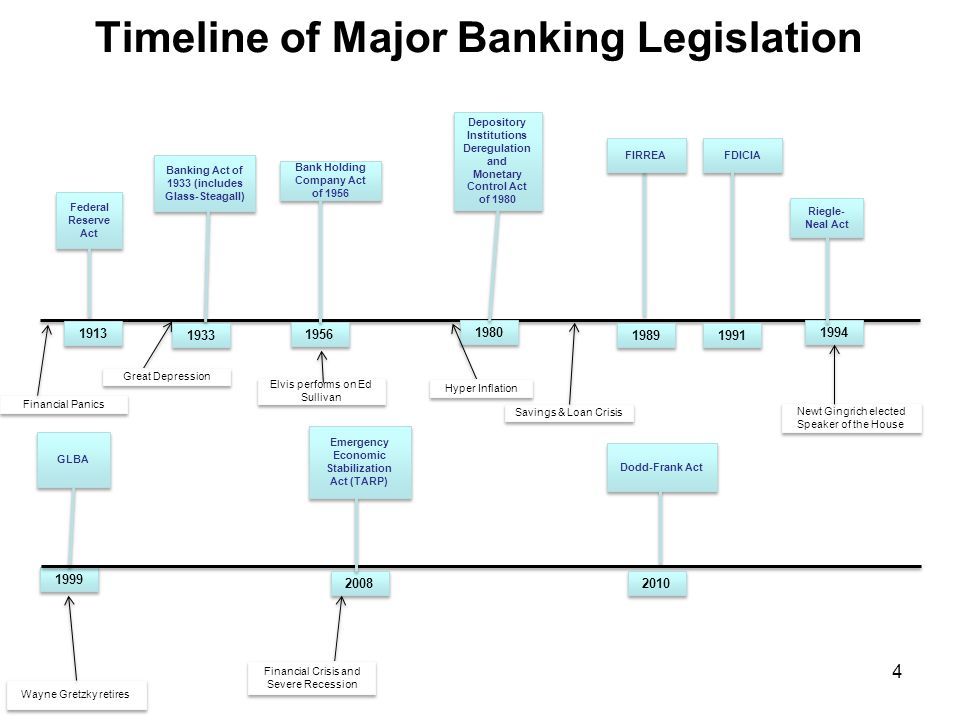

HISTORY OF FINANCIAL REGULATION

“If we want our regulators to do better, we have to embrace a simple idea: regulation isn't an obstacle to thriving free markets; it's a vital part of them.”

James Suroweicki - Financial Writer

Featured Educational Articles

educational awareness - Article Summaries

Educational awareness to make the best financial decision for your needs.

Extended Content - Various Resources

Supporting educational content relevant to financial planning considerations.