Federal Stimulus

Enacting a monetary policy to offset a cataclysmic economic or financial event

WISE Investments

New Podcast Series: PostPandemicInvestments.com

An educational podcast series dedicated to financial awareness for both novice and seasoned investors. We discuss the ideology into creating this one-of-a-kind educational resource center, focusing on financial awareness within a post-pandemic reality.

Frequently Asked Questions

Financial Stimulus and Monetary Policy

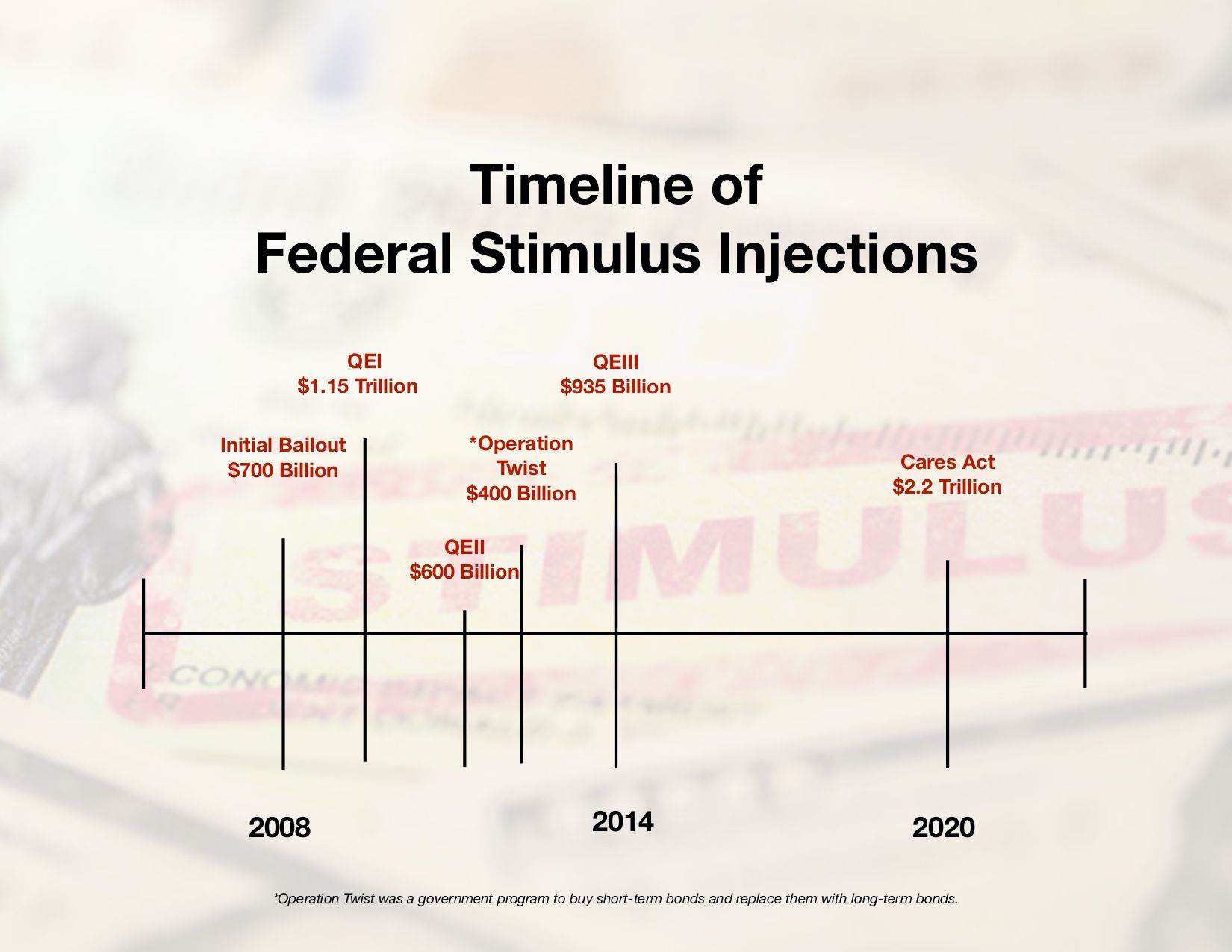

HISTORY OF THE FEDERAL STIMULUS

“Government spending is taxation. When you look at this, I've never heard of a poor person spending himself into prosperity; let alone I've never heard of a poor person taxing himself into prosperity.”

Arthur Laffer - Financial Writer

Featured Educational Articles

educational awareness - Article Summaries

Educational awareness to make the best financial decision for your needs.

Extended Content - Various Resources

Supporting educational content relevant to financial planning considerations.